As a Chinese crane manufacturer, Dongqi occupies a certain market share in China’s domestic crane market. As one of the global economic hot spots, East Asia has a profound background in the field of infrastructure construction. This is a sales area that no crane supplier can afford to give up. In this article, we will discuss the market size, application and future development trends of overhead cranes in East Asia.

East Asia Overhead Crane Market Overview

The East Asian Overhead Crane Market reached X USD in 2020, growing X% over the previous year. During the period under review, consumption showed a relatively flat trend pattern. In 2009, the growth rate was the fastest, with an increase of X% year-on-year. As a result, consumption reaches a peak level of X dollars. From 2010 to 2020, market growth failed to regain momentum.

By value, the 2020 overhead crane production is estimated to rise to X dollars at export prices. Overall, production recorded a relatively flat trend pattern. The most significant growth rate occurred in 2009, which was an X% increase compared to the previous year. As a result, production reached a peak level of X dollars. Production growth remained low from 2010 to 2020.

The country with the largest production of overhead cranes is China (X units), accounting for X% of the total. In addition, China’s overhead crane output exceeded the figure recorded by the second largest producer, Japan (X units) by six times. South Korea (X units) ranked third with X% of total production. From 2007 to 2020, the average annual growth rate of sales in China is +X%. Average annual production growth rates for the remaining producing countries are as follows: Japan (-X% per year) and South Korea (-X% per year).

Export situation of overhead cranes in East Asian countries

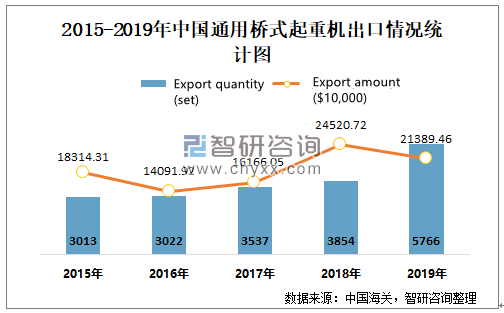

China General Purpose Overhead Crane Export Data

China is the largest exporter of fixed support overhead cranes in East Asia, with X units exported, which is close to X% of total exports in 2020. It was followed by South Korea (X units), which constituted X% of total exports. China is also the fastest growing country in terms of bridge crane exports with fixed supports, with a CAGR of +X% from 2007 to 2020.

South Korea (-X%) showed a downward trend over the same period. While China’s share (+X pp) in total exports increased significantly from 2007 to 2020, South Korea’s share (-X pp) showed negative dynamics. China ($X) remains the largest supplier of overhead cranes in East Asia by value, accounting for X% of total exports. In second place is South Korea ($X) with X% of total exports. In China, overhead crane exports grew at an average annual rate of +X% between 2007 and 2020.

The future development of China’s crane industry chain

At present, China’s lifting and transportation equipment manufacturing industry is under the centralized management of China Heavy Machinery Industry Association. China Heavy Machinery Industry Association is an industry self-regulatory organization. Its responsibilities are to implement national laws, regulations and policies, provide two-way services for the government and members, play the role of bridges and links between the government and enterprises, and actively reflect the wishes and requirements of members. Maintain the legitimate interests of the industry and members, promote the development of China’s heavy machinery industry, and provide various services such as investigation and research suggestions, self-discipline management, information guidance, consulting services, and international exchanges.

The “Thirteenth Five-Year Plan” proposes the implementation of high-end equipment innovation and development projects, which will significantly improve the level of independent design and system integration capabilities. Implement intelligent manufacturing projects, accelerate the development of key technologies and equipment for intelligent manufacturing, and strengthen the foundations of intelligent manufacturing standards, industrial electronic equipment, and core supporting software. Strengthen the construction of industrial Internet facilities, technology verification and demonstration and promotion, and promote substantial breakthroughs in “Made in China + Internet”. Cultivate and promote new intelligent manufacturing models, and promote the transformation of production methods to flexible, intelligent and refined. In the “Regulations on the Safety Supervision of Special Equipment” (Order No. 549 of the State Council), in addition to strict control over the safety of special equipment, new requirements are also put forward for the energy saving of special equipment. Due to the continuous improvement of the country’s requirements for crane safety, reliability and energy saving and consumption reduction, the market demand for lightweight, low energy consumption and high performance cranes has greatly expanded.

With the continuous expansion of industrial production scale and the improvement of production efficiency, the proportion of material handling in product production costs has gradually increased, and the demand for large-scale, high-speed and automated cranes by user enterprises has continued to increase, and energy consumption and reliability have also been raised. higher requirements. Crane performance has become an important part of automated production processes. The lifting capacity of China’s bridge and gantry cranes is getting bigger and bigger, the working speed is getting faster and faster, the degree of automation is getting higher and higher, and the technical content of the products is also obviously improving with the intensification of the international market competition.

Outlook for the development trend of the overhead crane market in East Asia in 2022

没有评论:

发表评论